Washington, D.C. — The future of the American digital asset economy hangs in the balance today as the White House convenes a high-stakes, closed-door summit to salvage the stalled CLARITY Act 2026. In a room packed with powerful banking lobbyists and crypto executives, the administration is attempting to broker a truce over the single most explosive issue in modern finance: stablecoin yield regulation. With the midterm elections looming, this "make-or-break" meeting represents the last best chance to pass comprehensive market structure legislation before the political calendar freezes progress indefinitely.

The Multi-Trillion Dollar Yield Battle

At the heart of the deadlock is a fierce disagreement over whether digital dollars can function like interest-bearing savings accounts. The CLARITY Act (H.R. 3633), which passed the House with bipartisan support in mid-2025, has hit a wall in the Senate Banking Committee due to "Section 404." This controversial provision, heavily backed by the banking lobby, seeks to ban crypto platforms from passing "rewards" or yield to customers holding stablecoins.

For traditional financial institutions, the stakes are existential. The Bank Policy Institute (BPI) and the American Bankers Association (ABA) have warned that allowing stablecoins to offer 3-5% APY could trigger a massive "deposit flight," potentially draining up to $6.6 trillion from the commercial banking system by 2028. "If unregulated tech firms can offer high-yield checking accounts without FDIC insurance or community lending requirements, we are looking at the destabilization of the entire fractional reserve system," noted a senior banking lobbyist prior to entering the West Wing.

White House Intervention: The "Witt Compromise"

Leading the negotiations is Patrick Witt, the Executive Director of the President’s Council of Advisors on Digital Assets. Witt’s team is reportedly pushing for a middle-ground solution—dubbed the "Witt Compromise" by insiders—that would distinguish between "passive interest" (which would remain the purview of banks) and "loyalty rewards" derived from protocol revenue.

The urgency of the White House crypto meeting cannot be overstated. With the 2026 midterms fast approaching, legislative time is running out. If the CLARITY Act fails to pass the Senate before the August recess, regulatory clarity could be delayed until 2027 or later, leaving the U.S. crypto market structure in limbo while jurisdictions like the EU and Singapore forge ahead with their own frameworks.

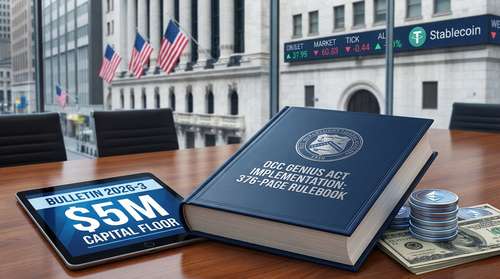

The GENIUS Act Loophole

The current standoff stems from ambiguity left by the GENIUS Act of 2025. While that bill established reserve requirements for issuers like Circle and Paxos, it inadvertently created a loophole allowing third-party exchanges to distribute "rewards" to users. Banks argue this effectively allows crypto firms to act as shadow banks, offering the benefits of yield without the regulatory overhead. The crypto industry, represented at the summit by heavyweights like Coinbase and the Blockchain Association, argues that banning these rewards stifles innovation and hurts consumers who are tired of near-zero interest rates on traditional deposits.

Industry Reaction and Market Impact

Crypto markets have reacted nervously to the news of the summit. Bitcoin and major stablecoins saw volatility spike in early trading as rumors circulated about the potential outcomes. A complete ban on stablecoin interest returns could decimate the business models of many DeFi protocols and centralized exchanges, which rely on yield to attract liquidity.

"This isn't just about interest rates; it's about whether the U.S. wants to lead in the digital economy or protect legacy incumbents," stated the CEO of a major U.S. crypto exchange. "The CLARITY Act 2026 was supposed to provide certainty, not a suffocating prohibition that drives capital offshore."

What Comes Next?

As the summit stretches into the evening, three potential outcomes are emerging:

- The Ban: The banking lobby wins, and the CLARITY Act prohibits all stablecoin yield, likely causing the bill to lose support from pro-crypto legislators.

- The Carve-out: A compromise allows "qualified institutions" to offer yield under strict banking-like capital requirements.

- The Delay: Talks collapse, effectively killing the bill for this legislative session.

For investors and industry watchers, the results of today's meeting will define the US crypto market structure bill for a generation. Whether digital assets will remain purely payment rails or evolve into wealth-generating instruments is now being decided behind closed doors at 1600 Pennsylvania Avenue.