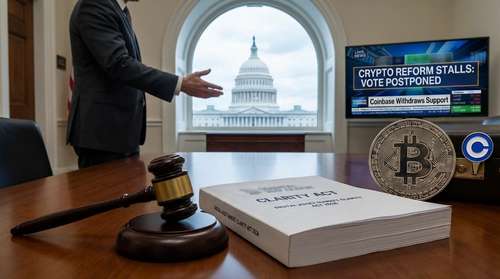

DAVOS, Switzerland — The fragile consensus surrounding the Digital Asset Market Clarity Act 2026 collapsed on Tuesday, throwing the future of U.S. crypto regulation into uncertainty. Coinbase, the largest cryptocurrency exchange in the United States, officially withdrew its support for the bill just hours before a critical CLARITY Act Senate vote was scheduled to advance to markup.

Speaking from the World Economic Forum in Davos, Coinbase CEO Brian Armstrong delivered the news that has sent shockwaves through Washington. "We would rather have no bill than a bad bill," Armstrong stated, citing last-minute amendments that he claims would suffocate the domestic industry. As a direct result of the withdrawal, Senate Banking Committee Chairman Tim Scott has indefinitely postponed the highly anticipated markup hearing, leaving the US crypto market structure bill in legislative limbo.

The Davos Bombshell: Brian Armstrong Breaks Ranks

The timing of the announcement was calculated for maximum impact. While lawmakers in D.C. were preparing for what was expected to be a contentious but successful markup, Brian Armstrong Davos crypto regulation discussions took a sharp turn. Armstrong argued that the latest draft of the legislation had drifted too far from its original promise of innovation, morphing instead into a regulatory cage that favors traditional financial incumbents.

"The bill in its current form includes a de facto ban on tokenized equities and imposes unworkable oversight on decentralized finance," Armstrong told reporters. "But the real poison pill is the restriction on stablecoin yields. This isn't about consumer protection; it's about protecting the banks from competition."

The reversal is a significant blow to the Digital Asset Market Clarity Act 2026, which had been crafted over months of bipartisan negotiation to finally provide regulatory certainty. Without the backing of the industry's heaviest hitter, the bill's political viability has evaporated overnight.

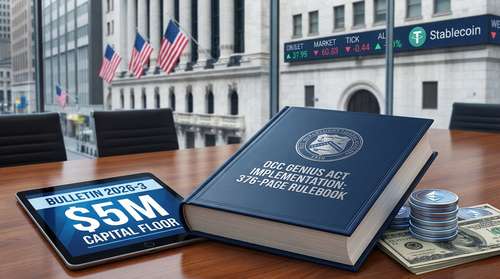

Stablecoin Yields: The Billion-Dollar Dealbreaker

At the heart of the dispute is stablecoin yield regulation news that has pitted crypto firms against powerful banking lobbyists. The contentious provision—effectively a ban on "pass-through" yields for stablecoin holders—was introduced to assuage fears that high-yield digital dollars could trigger deposit flight from community banks.

For Coinbase, however, this is an existential threat. With stablecoin revenue projected to top $1 billion in 2026, the ability to offer rewards on assets like USDC is a cornerstone of its business model. Banking groups have argued that allowing crypto platforms to offer interest-like returns without banking charters creates an uneven playing field. The Coinbase withdraws support CLARITY decision makes it clear that the exchange is unwilling to trade its revenue streams for a regulatory framework it views as flawed.

"The banks are trying to use regulation to kill a superior product," an industry insider noted. "Coinbase isn't just fighting for itself; it's fighting for the right of consumers to earn a return on their digital cash."

Senate Markup Postponed: White House Reportedly "Furious"

The political fallout in Washington has been swift. Senate Banking Committee Chairman Tim Scott confirmed the postponement of the markup, stating that "more time is needed to reach a consensus that protects consumers without stifling innovation." Behind the scenes, however, tensions are boiling over.

Reports from Capitol Hill suggest the White House is "furious" with the sudden pivot. The administration had viewed the US crypto market structure bill as a key legislative achievement for 2026. Sources close to the negotiations indicate that the White House may now consider pulling its support entirely if a compromise on yield cannot be reached, labeling the move a "rug pull" by the industry.

DeFi and the SEC-CFTC Tug-of-War

Beyond the economic fight over yields, the SEC CFTC jurisdictional split 2026 remains a thorny technical issue. The CLARITY Act was designed to clearly delineate authority: the CFTC would regulate digital commodities, while the SEC would oversee digital securities. However, Coinbase contends that recent redlines have tipped the scales back toward the SEC.

Armstrong and other DeFi advocates argue that the new language would effectively treat software developers as financial brokers, imposing strict liability on decentralized interfaces. "You cannot regulate a protocol like you regulate a bank," Armstrong emphasized at Davos. "If we pass this version, we are handing the keys of the future financial system to the SEC, an agency that has shown zero interest in fostering this technology."

Industry Reaction and What's Next

The collapse of the CLARITY Act markup leaves the U.S. significantly behind its global peers. While the European Union moves forward with MiCA implementation and jurisdictions like Bermuda announce "on-chain economies," the U.S. remains stuck in gridlock.

Other industry players are split. Some, like Kraken and a16z, have indicated they might still support a modified version of the bill, fearing that "perfect is the enemy of good." However, without Coinbase's endorsement, the path to 60 votes in the Senate is virtually impossible.

For now, all eyes are on the Senate Banking Committee to see if they can salvage the wreckage. Unless lawmakers can bridge the gap between protecting bank deposits and enabling crypto innovation, the Digital Asset Market Clarity Act 2026 may be dead on arrival.