In a decisive move that reshapes the future of digital infrastructure, Bitcoin mining titans CleanSpark (NASDAQ: CLSK) and Bitfarms (NASDAQ: BITF) have solidified their transition from pure-play cryptocurrency mining to high-performance computing (HPC) and artificial intelligence. As of January 16, 2026, the industry is witnessing what analysts are calling "The Great Mining Pivot," underscored by CleanSpark's massive 447-acre acquisition in Brazoria County, Texas, and Bitfarms' strategic executive overhaul to accelerate its U.S. expansion. With traditional mining margins compressed in the post-halving economy, these multi-billion dollar shifts signal a new era where data centers power not just the blockchain, but the generative AI revolution.

CleanSpark's Texas Expansion: A Gigawatt-Scale AI Hub

CleanSpark has officially anchored its AI ambitions with a definitive agreement to acquire a sprawling 447-acre site in Brazoria County, Texas. Announced this week, the deal positions the company to develop a colossal data center campus with an initial 300 megawatts (MW) of capacity, expandable to a staggering 600 MW. This acquisition creates a regional power hub for the company in the greater Houston area, now totaling over 890 MW of potential utility capacity when combined with its recent Austin County project.

Matt Schultz, CleanSpark’s CEO, emphasized that this isn't merely land banking; it's a calculated entry into the high-margin world of hyperscale computing. The Brazoria site is engineered specifically for the dense power requirements of AI training clusters, leveraging the region's robust high-voltage transmission lines. By securing transmission-level power, CleanSpark bypasses the bottlenecks that plague smaller interconnects, offering prospective hyperscale clients the rapid deployment capabilities they desperately need in 2026.

Infrastructure Built for the Future

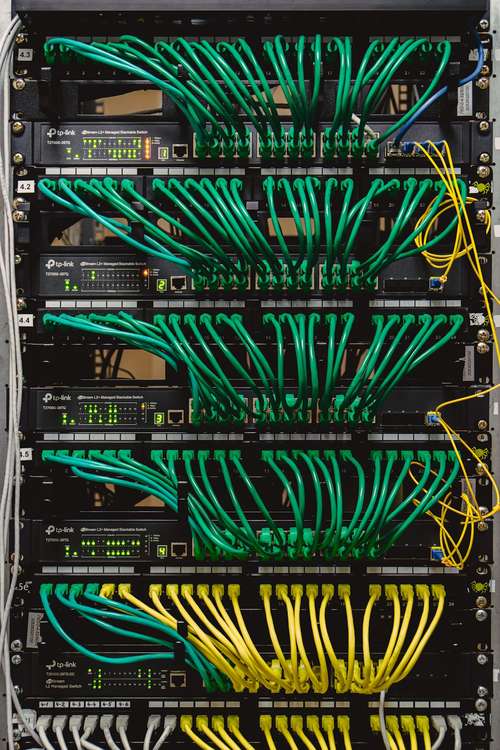

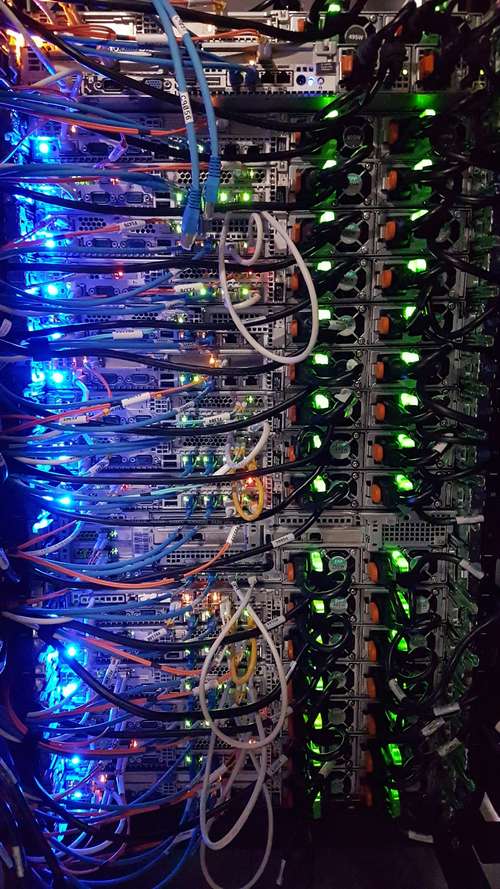

The Brazoria facility is designed to support immersion cooling AI systems, a critical necessity for next-generation chips like Nvidia's Blackwell architecture which generate immense heat. Unlike traditional air-cooled mining rigs, these AI-native campuses utilize advanced liquid cooling technologies to maintain optimal performance for continuous high-performance computing workloads.

Bitfarms Accelerates US Redomiciliation and HPC Strategy

Parallel to CleanSpark's infrastructure land grab, Bitfarms is executing a strategic corporate transformation. On January 14, the company announced a significant Board Chair transition, appointing U.S. energy veteran Fanny Hofmeister to replace Brian Howlett. This governance shake-up is a direct precursor to the company's planned redomiciliation to the United States, a move designed to unlock deeper capital pools and align the company with American institutional investors hungry for AI infrastructure plays.

Bitfarms is rapidly converting its portfolio, having recently exited Latin American operations to focus entirely on North American HPC opportunities. The company is currently retrofitting its Washington state facility with liquid-to-chip cooling solutions to host high-density GPU workloads. This "GPU-as-a-Service" model is projected to generate significantly higher revenue per megawatt compared to traditional SHA-256 Bitcoin hashing, validating the company's aggressive pivot away from sole reliance on crypto asset prices.

Crypto Mining Profitability 2026: The Economics of the Shift

The driving force behind this sector-wide transformation is the stark reality of crypto mining profitability in 2026. Following the 2024 halving, the cost of production for one Bitcoin has risen dramatically, squeezing margins for even the most efficient operators. In contrast, the AI compute market offers long-term, fixed-rate contracts with margins often exceeding 80%. By repurposing their vast power interconnects—arguably their most valuable asset—miners are effectively becoming energy arbitrageurs, swapping volatile crypto rewards for stable, high-yield lease agreements with tech giants.

For public mining stocks, this valuation disconnect is key. Wall Street has begun re-rating miners like CleanSpark and Bitfarms not as commodity producers, but as essential utility providers for the AI boom. With power grid queues backed up for years, the immediate availability of energized sites has turned miners into the new power brokers of the digital age.

The Role of Immersion Cooling and High Performance Computing

As the pivot accelerates, the technological requirements of data centers are changing. High performance computing (HPC) demands far greater reliability and cooling efficiency than Bitcoin mining. The shift toward immersion cooling—submerging servers in non-conductive liquid—is no longer experimental but mandatory for the power densities required by AI.

Both CleanSpark and Bitfarms are leveraging their expertise in managing large-scale electrical loads to build these next-gen facilities. Their ability to balance grid loads and participate in demand-response programs makes them ideal partners for energy grids in Texas and Pennsylvania, further stabilizing their operational costs while serving the always-on demands of artificial intelligence.

As 2026 unfolds, the line between Bitcoin miner and AI data center is blurring irrecoverably. For investors and industry watchers, the message is clear: the race for hashrate has become the race for compute, and the winners will be those who can plug the world's smartest algorithms into the most reliable power sockets.