The Bitcoin network has offered a rare moment of reprieve to its beleaguered mining sector, with difficulty dropping to 146.4 trillion in the first adjustment of 2026. This 1.2% decline—the first downward adjustment since October 2025—comes as operators struggle to balance thin margins against the industry's massive capital rotation into high-performance computing (HPC).

For miners facing an all-in break-even cost that has crept dangerously close to six figures, the difficulty drop is a welcome signal. However, industry analysts warn that this easing is less about organic network health and more a symptom of capitulation, as unprofitable hardware finally unplugs and top-tier firms like Core Scientific and TeraWulf divert gigawatts of power toward the lucrative artificial intelligence sector.

The 2026 Profitability Squeeze: By the Numbers

The post-2024 halving economics are still exacting a heavy toll on pure-play miners. Despite Bitcoin trading in a robust range, the relentless climb in network hashrate throughout late 2025 pushed the Bitcoin hash price index—a key measure of daily revenue per terahash—to historic lows. The difficulty drop to 146.4T indicates that approximately 2.5 gigawatts of inefficient mining capacity has recently gone offline, likely unable to survive the latest difficulty epoch.

Data from the start of January reveals a stark reality: for many legacy fleets, the cost to mine a single Bitcoin, including depreciation and energy, currently hovers near $101,500. With spot prices trading below this threshold for parts of the week, the shut-off price for S19-era machines has effectively been breached. This "miner capitulation" is the primary driver behind the difficulty adjustment, acting as a natural circuit breaker for the network.

The Great AI Pivot: Infrastructure as the New Gold

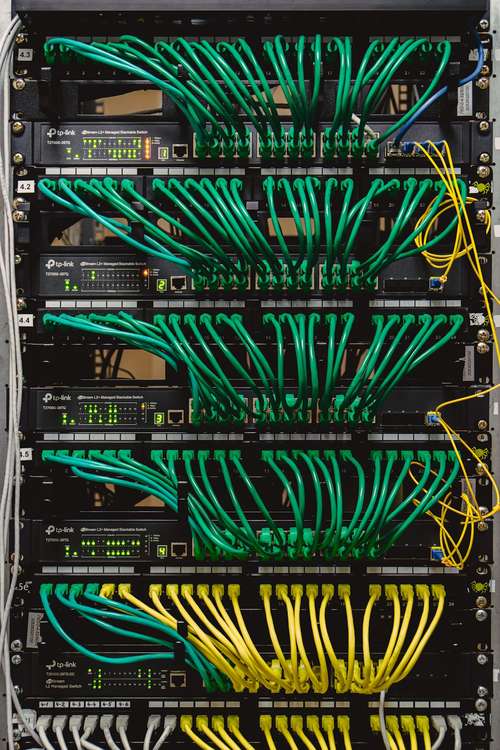

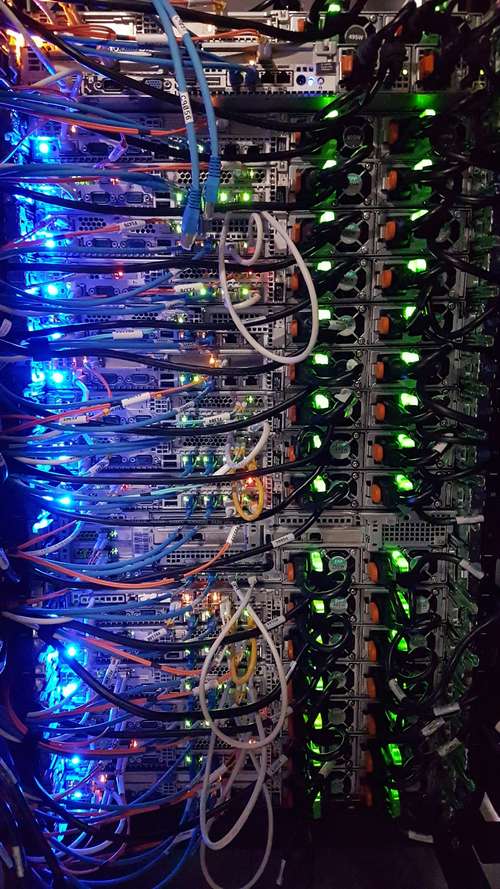

While difficulty stabilizes, the industry's survival strategy has shifted decisively from hashing to hosting. The "AI pivot" is no longer just a narrative—it is the dominant operational reality of 2026. American miners are aggressively repurposing their energization infrastructure, realizing that the stable revenue of AI data centers offers a hedge against crypto volatility.

Leading the charge is Core Scientific, which has set the template for this transformation. Following its expanded agreement with CoreWeave, the company is now allocating over 590 megawatts (MW) of its capacity to HPC workloads. This strategy effectively decouples a significant portion of their revenue from the fluctuating price of Bitcoin, replacing it with long-term, fixed-rate contracts for hosting NVIDIA GPU clusters.

Analysts project that nearly 20% of Bitcoin miner power capacity will transition to AI and HPC workloads by the end of 2027. This structural shift is creating a two-tiered industry: "Hybrid" miners who use Bitcoin mining as a flexible load-balancing tool while prioritizing AI clients, and "Pure-Plays" who remain fully exposed to the brutal economics of the difficulty algorithm.

Political Headwinds and Energy Independence

The transition hasn't been without friction. As miners rebrand themselves as "data center infrastructure providers," they are drawing fresh scrutiny regarding energy consumption. On January 12, former President Donald Trump commented on the strain data centers place on the grid, emphasizing that tech giants must "pay their own way" rather than passing infrastructure costs to consumers. This political rhetoric adds a layer of complexity for miners looking to secure long-term power purchase agreements (PPAs) for their AI retrofit projects.

Despite this, the synergy between Bitcoin mining and AI is undeniable. Miners control the one asset AI hyperscalers desperately need: immediate access to power. While building a new greenfield data center can take 3-5 years due to substation queues, a Bitcoin mining facility can be retrofitted for HPC in under 18 months. This time-to-market advantage is currently the most valuable asset on miners' balance sheets.

Outlook for Q1 2026

Looking ahead, the mining difficulty adjustment in January suggests the network is finding a temporary equilibrium. If Bitcoin's price pushes past the $105,000 resistance level, we may see idle machines turn back on, pushing difficulty back toward the 150T mark. However, if the pivot to AI accelerates, the growth of Bitcoin's hashrate may slow structurally, as the world's most powerful chips are deployed not for SHA-256 hashing, but for training the next generation of large language models.