In a decisive move to end years of regulatory ambiguity, the SEC and CFTC have effectively launched "Project Crypto," a historic joint initiative to harmonize federal oversight of the digital asset sector. This announcement coincides with the Senate Agriculture Committee's advancement of the Digital Commodity Intermediaries Act, signaling a massive shift in US crypto regulation 2026. As SEC Chairman Paul Atkins and CFTC Chairman Michael Selig align their agencies, the era of "regulation by enforcement" appears to be yielding to a new framework of cooperation and clarity.

Project Crypto: Ending the Turf War

For over a decade, the crypto industry has navigated a minefield of conflicting guidance between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Project Crypto SEC CFTC represents the first formal attempt to bridge this gap. Officially unveiled during a joint summit and elaborated upon in media appearances this week, the initiative aims to establish a unified regulatory taxonomy that categorizes digital assets based on their fundamental properties rather than relying solely on decades-old legal precedents.

SEC Chairman Paul Atkins, speaking on national television Friday, emphasized that the goal is to position the United States as the undisputed global leader in digital finance. "The future of finance will be built somewhere," Atkins stated. "Through Project Crypto, we ensure it is built here." The initiative introduces a four-part taxonomy distinguishing between Digital Commodities, Digital Collectibles, Digital Tools, and Tokenized Securities. This clarity is expected to unlock billions in institutional capital that has been sidelined by regulatory uncertainty.

Senate Advances Digital Commodity Intermediaries Act

While regulators align via Project Crypto, Congress is moving forward with the legislative backbone of the new market structure. The Senate Agriculture Committee has advanced the Digital Commodity Intermediaries Act (DCIA), a crucial piece of the crypto market structure bill puzzle. The legislation, which cleared the committee largely along party lines, explicitly grants the CFTC primary jurisdiction over "digital commodities" like Bitcoin and Ether, treating them similarly to traditional commodities such as gold or oil.

The bill's progress is a significant milestone for CFTC digital asset oversight. It mandates that trading platforms offering these assets register with the CFTC, subjecting them to strict requirements regarding customer protection, transparency, and market integrity. Crucially, the DCIA creates a "safe harbor" for developers and provides a clear pathway for digital commodity brokers to operate without fear of retrospective SEC enforcement actions.

Defining the Boundaries: SEC vs. CFTC

One of the most complex aspects of the new framework is the division of labor. Under the emerging consensus, the SEC retains authority over Tokenized Securities—assets that represent ownership in traditional financial instruments recorded on a blockchain. Meanwhile, the CFTC takes the lead on decentralized commodities. This bifurcation is designed to prevent the "regulation by enforcement" tactics that characterized the previous administration, a change underscored by the SEC's recent dismissal of legacy proceedings against several DAO entities earlier this week.

Stablecoins and the Road Ahead for 2026

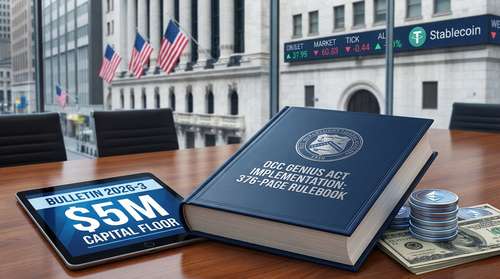

The legislative push doesn't stop with commodities. US stablecoin legislation 2026 remains a top priority, with White House officials meeting key industry stakeholders this week to resolve lingering disputes over reserve requirements and state vs. federal licensing. The resolution of these stablecoin debates is seen as the final pillar needed to complete the US digital asset ecosystem, potentially paving the way for a digital dollar or privately issued equivalents to dominate global settlement layers.

The broader US crypto regulation 2026 landscape is rapidly evolving from a patchwork of state laws into a cohesive federal strategy. With the GENIUS Act already influencing agency rulemaking and Project Crypto operationalizing the details, market participants are finally seeing the "rules of the road" necessary for long-term innovation. As the Senate prepares to reconcile the DCIA with banking committee proposals, the coming months will be critical in codifying these changes into permanent law.