In a definitive signal that the landscape of digital asset infrastructure is undergoing a seismic transformation, Riot Platforms has executed its largest treasury liquidation to date. The Castle Rock-based mining giant sold over 2,200 Bitcoin (BTC) across November and December 2025, generating nearly $200 million in proceeds. This massive capital injection is not for expanding its hash rate, but for a strategic Bitcoin mining pivot 2026 that will see the company aggressively transition into high-performance computing (HPC) and artificial intelligence infrastructure.

Funding the AI Data Center Migration

The sheer scale of Riot’s liquidation has sent ripples through the market. According to recent filings, the company offloaded 1,818 BTC in December alone at an average price of roughly $88,870, following a November sale of 383 BTC. This war chest—totaling approximately $198.6 million—is earmarked specifically for the development of its Corsicana, Texas facility.

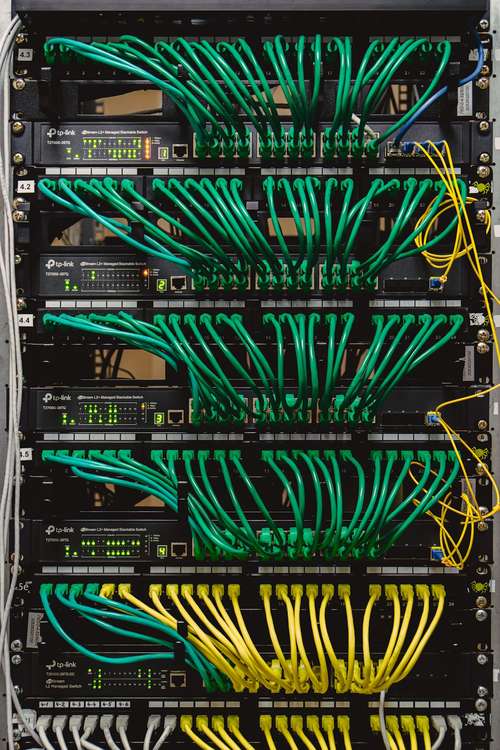

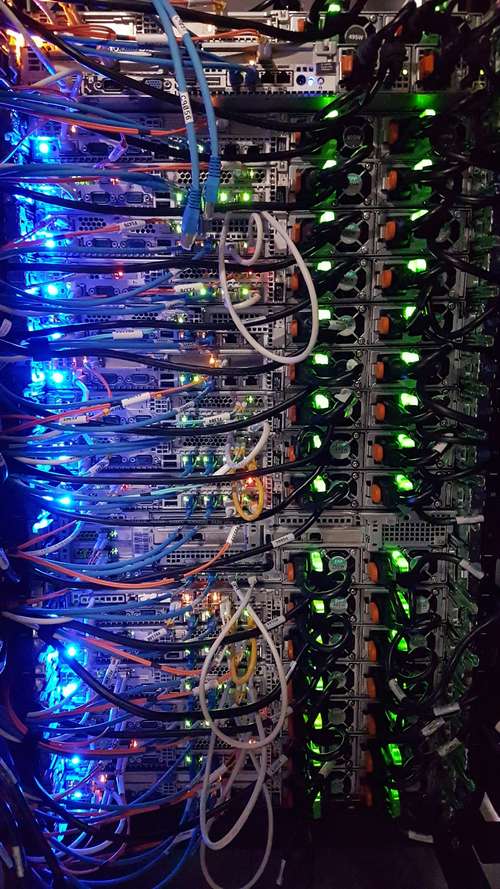

Unlike previous expansions focused on SHA-256 mining for Bitcoin, this capital is directed toward Phase 1 of a 112-megawatt AI data center migration. With completion targeted for Q1 2027, Riot is effectively betting the farm that the insatiable demand for generative AI compute will offer more stable, higher-margin returns than the increasingly volatile economics of cryptocurrency mining. "This is no longer just about securing the blockchain," said a source close to the company's operations. "It is about leveraging gigawatt-scale power capacity to fuel the next industrial revolution."

Mining Difficulty Adjustment 2026: A Sector Under Pressure

The timing of Riot’s pivot is hardly coincidental. Early January marked the first mining difficulty adjustment 2026, which saw a 2.6% decline to approximately 146 trillion. While a difficulty drop typically offers relief to miners, this adjustment underscores a darker reality: marginal operators are capitulating.

The Post-Halving Squeeze

Nearly two years after the 2024 halving, crypto mining profitability remains under immense pressure. The break-even price for many pure-play miners has crept dangerously close to spot prices, squeezed by rising energy tariffs and hardware depreciation. By diversifying into HPC infrastructure crypto models, Riot is following a survival blueprint drafted by peers like Core Scientific, aiming to decouple its revenue from the violent swings of the Bitcoin spot price.

Riot Platforms BTC Sales and Treasury Strategy

Historically known for its "HODL" strategy, Riot Platforms BTC sales of this magnitude represent a fundamental shift in corporate philosophy. The liquidation reduced the company’s Bitcoin holdings to roughly 18,005 BTC by the end of 2025. While still one of the largest corporate treasuries in the world, the willingness to drawdown these reserves highlights the capital-intensive nature of building Tier 3 data centers suitable for AI workloads.

Investors have reacted with cautious optimism. While the reduction in Bitcoin exposure removes some leverage to potential bull runs, the promise of predictable, contract-based revenue from hyperscalers provides a hedge against the "crypto winter" cycles that have historically plagued the sector. The market is beginning to value power capacity—specifically connected, energized capacity—at a premium over raw hashrate.

The New Hashrate Strategy: Watts Over Hashes

Riot’s move cements a broader industry trend where the metric of success is shifting from Exahashes per second (EH/s) to Megawatts (MW) of AI-ready power. This hashrate strategy evolution suggests that the most valuable asset a miner holds in 2026 is not their ASIC fleet, but their power purchase agreement (PPA).

With the Corsicana site boasting potential for 1 gigawatt of total capacity, Riot is positioning itself not just as a miner, but as an energy infrastructure sovereign. As AI models grow exponentially larger, the convergence of Bitcoin mining energy infrastructure and high-performance computing seems inevitable. Riot Platforms has made its move; the question remains which other giants will follow suit before the available power capacity is snapped up by Silicon Valley's hyperscalers.