In a stunning reversal that has upended months of legislative negotiations, Coinbase has officially withdrawn its support for the Senate Banking Committee's revised version of the Digital Asset Market Clarity (CLARITY) Act. The move, announced late Wednesday by CEO Brian Armstrong, forced Committee Chairman Tim Scott (R-SC) to indefinitely postpone a high-stakes markup session scheduled for the following morning, leaving the future of comprehensive U.S. crypto regulation hanging in the balance.

The Dealbreakers: Why Coinbase Walked Away

For months, the CLARITY Act (H.R. 3633) was viewed as the industry's best hope for moving beyond the "regulation by enforcement" era. However, the latest Senate draft introduced provisions that Armstrong described as "materially worse than the status quo." The breaking point appears to have been a suite of last-minute amendments pushed by banking lobbyists that would effectively ban stablecoin rewards programs—a critical revenue stream for exchanges and a key feature for retail investors.

"We'd rather have no bill than a bad bill," Armstrong stated in a post on X (formerly Twitter), marking a rare moment of public defiance against a legislative package the industry had previously championed. Beyond the stablecoin provisions, Coinbase cited deep concerns over new restrictions on tokenized equities and aggressive surveillance mandates for decentralized finance (DeFi) protocols. The exchange argued these changes would not only stifle innovation but essentially hand a monopoly on digital yield products to traditional banks, killing crypto's ability to compete.

Senate Scramble: Markup Halted at the Eleventh Hour

The political fallout was immediate. Senator Tim Scott, who had hoped to fast-track the bill as a signature achievement of his chairmanship, was forced to scrap the Thursday markup session just hours before it was set to begin. Insiders on Capitol Hill report that the committee room was already prepped for the vote when the news broke.

Partisan Fault Lines Reopen

The delay has reopened partisan wounds that the initial House version of the bill—which passed with bipartisan support in July 2025—had managed to suture. Senate Democrats, emboldened by the breakdown, are now calling for stricter consumer protections, while pro-crypto Republicans are accusing the banking lobby of sabotaging the bill to protect their market share. "This was a brass-knuckles fight behind closed doors," said one senior aide familiar with the negotiations. "The banks wanted to ensure that if digital assets are the future, they own the rails. Coinbase refused to sign that surrender."

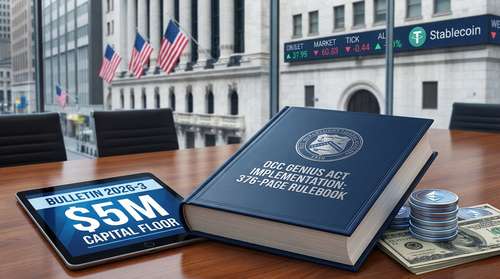

Context: The GENIUS Act and the Fight for Yield

To understand the gravity of this standoff, one must look at the legislative landscape established last year. The passage of the GENIUS Act in 2025 created a federal framework for stablecoin issuers but left the regulation of secondary market activities—like rewards and trading—to this market structure bill. By attempting to use the CLARITY Act to retroactively limit yield-generating products, lawmakers have touched a "third rail" for the crypto industry.

Analysts at Bernstein note that stablecoin rewards have become a cornerstone of the crypto economy, offering consumers yields that often outpace traditional savings accounts. A ban on these rewards would not only hurt exchange revenues but could drive millions of U.S. users to unregulated offshore platforms, defeating the very purpose of the legislation. Coinbase's refusal to compromise on this point signals that the industry is no longer willing to accept regulatory clarity at any cost.

What's Next for U.S. Crypto Regulation?

The path forward is murky. While Senator Scott has insisted that the bill is "not dead," the trust deficit between the crypto lobby and the Senate Banking Committee is at an all-time high. Negotiations are expected to resume this week, but with the 2026 midterms looming, the window for passing complex financial legislation is rapidly closing. For now, the U.S. remains without a unified regulatory framework, and the industry is bracing for a renewed battle to ensure that the next version of the CLARITY Act protects not just the banks, but the future of digital finance itself.