Bitcoin mining difficulty dropped by 7.8% over the weekend, a significant decline similar to that seen after the FTX collapse in 2022.

According to CoinDesk, the network's mining difficulty fell from 83.6 terahash per second (TH/s) to 79.50 TH/s on June 5.

This level of difficulty was last observed in March, just before the halving in April.

Impact on Miners' Revenues and Operations

Julio Moreno, head of research at CryptoQuant, noted that the network hash rate experienced a 7.8% drawdown, similar to the one seen after the FTX collapse in December 2022.

Moreno stated that miners' daily revenues have decreased from $78 million to $26 million since the halving.

Bitcoin's mining difficulty has been decreasing since early May, primarily due to a reduction in the network hash rate.

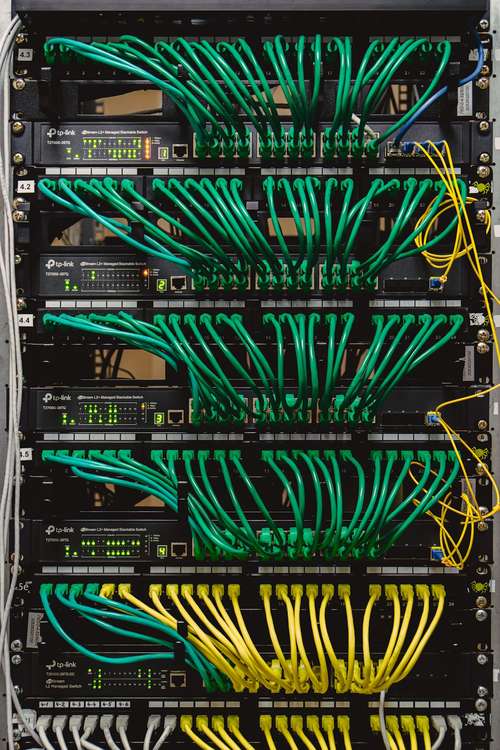

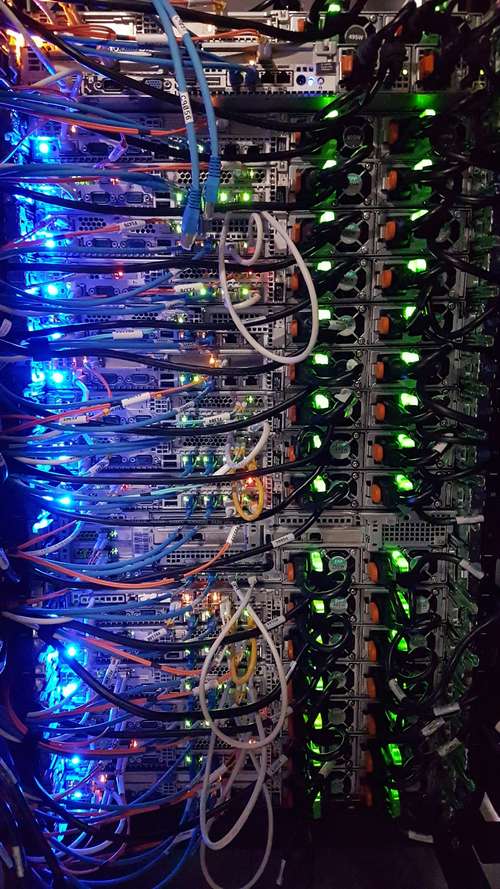

This decline has prompted many miners to deactivate their equipment in response to reduced profitability.

As mining difficulty decreases, the network's hashing power correspondingly reduces, thereby presenting an opportunity for smaller miners and potentially enabling previously unprofitable mining operations to become profitable once again.

In June, miners significantly contributed to the selling pressure on Bitcoin, with over $1 billion worth of BTC being liquidated in a span of two weeks. This selling pressure contributed to maintaining Bitcoin's price within the range of $65,000 and $70,000.

Bitcoin Mining Process and Market Reactions

Miners use extensive computing power to solve complex encryptions and produce blocks on the Bitcoin blockchain.

Each block rewards miners with 6.25 BTC, which they typically sell to fund or expand operations.

Recently, the market has faced additional selling pressure from the defunct Mt. Gox and a German government entity, causing Bitcoin's price to drop briefly to as low as $53,500 last week.

The drop in Bitcoin mining difficulty comes as the mining sector undergoes consolidation.

For instance, on July 2, Iris Energy Limited (IREN) announced securing $413 million to expand its Bitcoin mining operations.

This funding is part of a broader capital raise of $425.3 million aimed at enhancing data centre capacity and scaling mining operations.

The expansion plans indicate a bullish outlook for the mining sector despite the recent drop in mining difficulty.

Challenges and Security Concerns

Jameson Lopp, a prominent Bitcoin advocate, highlighted the theft of Bitcoin mining equipment as another challenge for the industry.

According to Benzinga, last Thursday, Lopp took to social media to share news of two separate arrests made in connection with the theft of Bitcoin mining hardware.

One arrest occurred in Los Angeles, while the other took place in Baton Rouge.

Lopp pointed out the folly of such thefts, noting that the stolen devices quickly depreciate in value when not in use.

“Don’t they know these devices rapidly lose value while sitting in storage?” he asked.

The rapid depreciation of Bitcoin mining devices when not in use is a notable concern for the industry.

Such thefts not only disrupt operations but also diminish the value of the stolen equipment, making it a futile effort for the thieves.