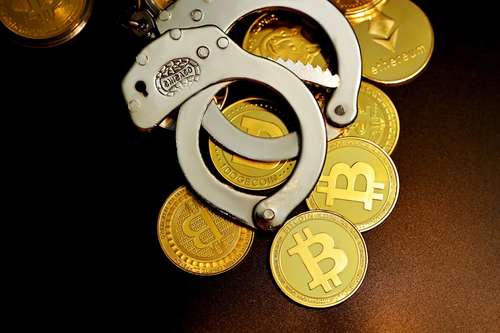

Travis Ford, the co-founder of Wolf Capital, has been sentenced to five years in prison following his involvement in a massive $9.4 million Ponzi scheme. The shocking revelation has rocked the investment community, leaving many investors to wonder how such deceit could go undetected for so long. The case draws attention to ongoing issues with crypto-related fraud and financial misconduct. In this article, we explore the scheme, its effects on investors, and the lessons learned from this legal consequence.

This verdict underscores the importance of vigilance when investing, particularly in the volatile world of digital currency and crypto trading schemes. Many people were drawn in by promises of high returns and the allure of quick profits, only to face devastating financial losses. As we unravel the details, it’s clear that this isn't just a tale of one man's downfall, but a cautionary story that reflects larger trends in financial crime and investor deception.

One might ask, how does such a Ponzi scheme manage to operate under the radar? And what concrete steps can be taken to prevent similar fraudulent activities in the future? The case against Ford offers some insight, and we’re here to dig into every angle of it.

Details of the Scheme

The scheme essentially operated under the guise of a legitimate crypto trading platform. Ford, along with other team members at Wolf Capital, promised extraordinary returns to lure in investors. By using aggressive marketing tactics and exaggerated claims of success, he managed to convince over 2,800 individuals to part with their money. The funds were misappropriated and funneled into a labyrinth of fraudulent activities, typical of a Ponzi scheme where early investors’ funds are used to pay returns to later investors.

Ever wonder how a financial fraud like this fools so many? It’s all about keeping a convincing façade and utilizing sophisticated techniques to hide the truth. In Ford’s case, he exploited the volatile nature of crypto assets, blending legitimate trading claims with deceitful promises of high returns. This mix of legitimate and illegitimate activities made it challenging for even seasoned investors to spot the red flags. The result was an elaborate dance of deception that fooled many until the eventual court ruling brought everything into sharp focus.

The court presented compelling evidence of systemic manipulation within Wolf Capital. It was noted how Ford exploited investor trust, using persuasive sales pitches and overly optimistic performance figures to mask the true nature of his investment scam. The case stands as a stark reminder of how something that appears to be a promising financial venture can quickly turn into a trap when based on fraudulent practices.

Investor Impact and Broader Implications

In this part of the discussion, the focus shifts to the investors who put their faith and savings into what they believed to be a secure financial opportunity. Many of these investors faced crippling losses as the fraudulent nature of the scheme slowly came to light. The emotional and financial toll on them has been significant, highlighting a crucial need for greater transparency and vigilance in such investments.

Experiencing a financial scam can feel like suddenly driving off a cliff: you are caught off guard by unexpected consequences no matter how careful you are. Investors in this case were misled by promises of financial prosperity that turned out to be nothing more than illusions. The aftermath has understandably led to a crisis of trust in similar ventures within the cryptocurrency community.

There is an essential lesson here that echoes across various investments: always be skeptical of promises that sound too good to be true. The fraudulent activities orchestrated by Ford and his team underscore the inherent risks associated with unverified investment opportunities, especially in a market where regulatory oversight can sometimes lag behind innovation. The case confirms that rigorous due diligence and careful verification are necessities, not luxuries, for anyone venturing into investment schemes.

Legal Ramifications and What Lies Ahead

From a legal standpoint, the sentencing of Travis Ford sends a strong message to anyone involved in financial misconduct within the investment realm. The five-year prison sentence is a clear indication that the justice system is putting its foot down on fraudulent activities. This decisive action demonstrates that legal consequences are inevitable for those who manipulate the truth to amass wealth at the expense of unsuspecting investors.

Legal experts stress that the conviction is not just about punishing one individual; it’s about setting a precedent. The court ruling has broader implications for how investment scams are handled in the future, particularly those related to cryptocurrencies. The detailed investigation into financial fraud reaffirms that the legal system is evolving alongside the complexities of modern financial markets. Investors and companies alike must be prepared for stricter regulatory scrutiny as authorities continue to clamp down on Ponzi schemes and other types of investment fraud allegations.

When you see headlines about a co-founder being sentenced for such misconduct, it’s a stark wakeup call. It forces us to consider the risks involved when we invest in areas with less oversight and regulatory guidance. Although the crypto market is a playground for innovation, it also serves as fertile ground for schemes that exploit this lack of regulation, leading to serious legal consequences for those involved.

Ford’s sentencing is a verdict that reaffirms the message: there is zero tolerance for deceiving investors. The justice system's firm stance on this kind of financial crime is a nod to the need for reform and tighter controls in the investment landscape. This development might even lead to more rigorous measures to protect consumers against future fraud, and it certainly has investors thinking twice before diving into unproven ventures.

Lessons Learned from the Case

This case is a textbook example of how investor deception can lead to devastating outcomes. It reminds me of the timeless adage—if it sounds too good to be true, then it probably is. The fraudulent activities orchestrated by Ford were a stark warning that behind flashy pitches and lofty promises may lie a labyrinth of deceit. Many investors fell victim to the allure of high returns promised by Wolf Capital, only to be caught up in a Ponzi scheme that had severe legal repercussions.

When you consider the impact of the scheme, it feels like a broken mirror reflecting countless shattered dreams. Investors, who once thought they were stepping into a promising financial opportunity, ended up entangled in a maze of fraudulent practices. The sentencing outcome is a signal to both current and future investors: rigorous due diligence and skepticism are your best defenses against financial fraud.

By understanding the mechanisms behind such scams, we can better arm ourselves against them. It’s a call to action for not only investors but also regulators to ensure that the fast-paced world of cryptocurrency does not become a breeding ground for similar investment scams. This case is more than just a headline—it’s a reminder of the very real consequences of financial misconduct.

In closing, the sentencing of Travis Ford illustrates the relentless pursuit of justice in the face of fraudulent activities. It serves as a stark reminder that no matter how innovative or promising an investment may appear, it is always crucial to exercise caution. With proper regulatory oversight and vigilant investors, we can hope for a future where financial fraud is minimized, and the integrity of investment markets is upheld.