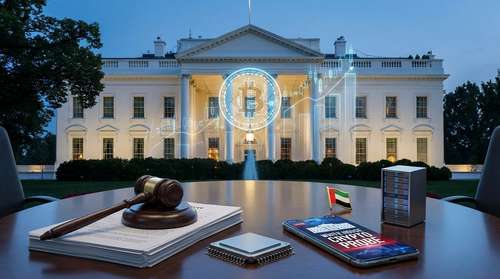

A political firestorm has erupted in Washington this week following explosive revelations that a key member of the United Arab Emirates royal family invested $500 million into World Liberty Financial, the cryptocurrency venture co-owned by the Trump family. The disclosure, detailed in a bombshell report by the Wall Street Journal, has triggered immediate calls from lawmakers and ethics experts for a congressional investigation. At the heart of the controversy is a potential quid pro quo involving the administration's subsequent approval of a massive Nvidia AI chips export deal to the Gulf nation, raising serious conflict of interest concerns just as crypto market news 2026 dominates financial headlines.

The $500 Million "Spy Sheikh" Deal

According to documents reviewed by investigators, the $500 million investment was finalized just four days before President Trump's inauguration in January 2025. The capital came from an entity controlled by Sheikh Tahnoon bin Zayed Al Nahyan, the UAE's national security adviser and brother to the country's president. Often referred to as the "Spy Sheikh" due to his intelligence role, Tahnoon acquired a massive 49% stake in World Liberty Financial.

The financial breakdown of the deal is drawing intense scrutiny. Reports indicate that approximately $187 million of the initial payment flowed directly to Trump family entities, while another $31 million went to interests associated with Steve Witkoff, the President's Special Envoy to the Middle East. "This is not just a business deal; it's a direct transfer of wealth from a foreign government official to the President's family immediately preceding a major shift in U.S. foreign policy," said Donald Sherman, an ethics watchdog spokesperson.

Nvidia AI Chips: The Quid Pro Quo?

The timing of the investment is the primary driver of the presidential conflict of interest allegations. Just months after the Trump crypto investment was sealed, the White House reversed a Biden-era restriction, greenlighting the export of 500,000 high-performance Nvidia AI chips to the UAE. These chips are critical for developing advanced artificial intelligence and were previously blocked due to fears they could be diverted to China.

Critics argue the sequence of events suggests a transactional relationship. "The timeline is damning," noted a senior policy analyst. "First comes the $500 million personal windfall, then comes the reversal of a major national security decision regarding sensitive technology. It looks less like diplomacy and more like a purchase order." The administration has denied any correlation, with White House spokespeople maintaining that the President is not involved in the day-to-day operations of World Liberty Financial.

Lawmakers Demand Immediate Investigation

Capitol Hill has reacted with fury. Senator Elizabeth Warren (D-MA) blasted the arrangement as "corruption, plain and simple," and has formally requested that the Senate Banking Committee open an investigation. "The American people need to know if their national security is being sold off for crypto cash," Warren stated in a press release yesterday. Senator Chris Murphy (D-CT) echoed these sentiments, suggesting the deal could constitute a violation of the Emoluments Clause.

Focus on Administration Officials

The scrutiny is expanding beyond the President. Lawmakers are calling for testimony from Steve Witkoff and David Sacks, the White House "AI and Crypto Czar." Both men have deep ties to the UAE crypto deal and the subsequent technology transfer policies. Investigators are particularly interested in whether these officials facilitated the chip export approval while holding financial interests in the entities benefiting from Emirati investment.

Market Reaction: WLFI Tanks on News

Despite the massive capital injection, the market reaction for World Liberty Financial's token (WLFI) has been negative. In a classic "sell the news" event, the token's price plummeted over 20% following the report. Investors appear skittish about the looming regulatory crackdown and the legal risks now hanging over the project.

This volatility is rippling across the broader sector. Bitcoin price analysis for February 2026 shows the market effectively ignoring the World Liberty news, decoupling the controversial project from the wider crypto ecosystem. While Bitcoin remains stable, tokens associated with politically exposed persons (PEPs) are seeing increased volatility as traders price in the risk of tighter regulations.

What Comes Next?

As the calls for a probe grow louder, the White House faces a significant political challenge. With the Senate Judiciary Committee likely to take up the issue, the coming weeks will be critical. If a formal inquiry is launched, it could lead to subpoenas for financial records that might reveal the full extent of the World Liberty Financial deal. For now, the intersection of high-stakes geopolitics and cryptocurrency has created a scandal that shows no signs of fading.