On August 8, 2024, Russian President Vladimir Putin passed a legislation allowing the mining of cryptocurrencies in Russia, indicating a fundamental change in the country's attitude toward digital assets. The legislation will become effective in November 2024, and it permits both large-scale and small-scale crypto mining operations within Russian territory.

The New Legislation: What it Entails

The recently enacted law presents a thorough framework for Russian crypto mining. The regulation states that only Russian legal companies and individual businesses registered with the government will be authorized to mine cryptocurrencies. Also, individual miners can engage without registration, provided their energy use stays below government-defined limitations.

This legislation also implements a restriction on promoting cryptocurrencies and making the assets available to an almost limitless audience. The law mandates that miners report the digital money they acquire from mining to a government-authorized entity. This action seeks to provide regulation control and openness in the crypto mining industry.

Reasons for Legalizing Crypto Mining

The legalization of crypto mining in Russia is part of a larger plan Putin has in place to lessen Russia's dependency on US dollars and conventional banking institutions. The sanctions imposed as a result of Russia's war actions in Ukraine have severely restricted the country’s access to international financial markets. Russia has been looking at other ways to do cross-border trade, and mining cryptocurrencies seems to be a good one.

The bill also fits Russia's involvement in the BRICS economic group (Brazil, Russia, India, China, and South Africa), which has been looking for means to lessen reliance on Western financial institutions. Legalizing crypto mining allows Russia to include digital currencies in its economic system, which could open the path for a digital currency supported by BRICS in the future.

Effects on the Global Cryptocurrency Market

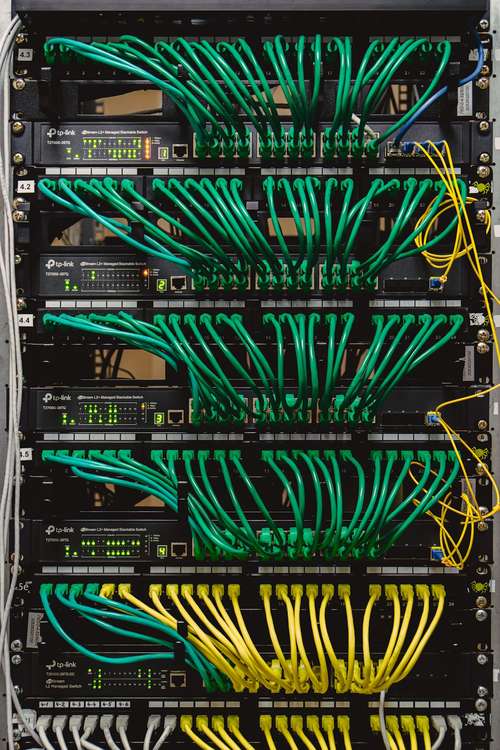

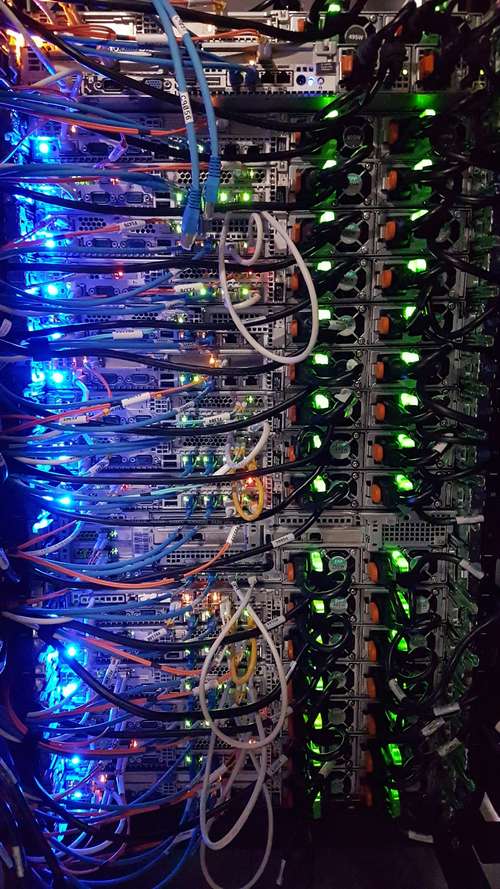

Russia’s legalization of crypto mining is going to have a ripple impact on the worldwide crypto scene. Russia's enormous natural resources, especially its energy reserves, make it a desirable site for crypto mining operations, an activity that requires a lot of energy. With official support, Russia could challenge nations like China and the United States by becoming among the top crypto mining hotspots worldwide.

The crypto community has mostly welcomed Putin's announcement allowing cryptocurrency mining in Russia. Industry analysts think that this action will bring more stability and expansion in the cryptocurrency sector.

However, some experts have expressed worries over the possible effects of the new bill on small-scale miners. They believe this regulation might present difficulties for individual miners who may not have the means to satisfy registration and compliance with energy usage criteria.

Future Prospects

The legalization of crypto mining in Russia may open the path for further advancements in the digital asset ecosystem of the nation. With the legislation scheduled to take effect from November 1, 2024, stakeholders have ample time to adjust to the new regulatory scene.

Apart from allowing crypto mining, the Russian government is also investigating the use of cryptocurrencies for cross-border payments and trade. Beginning on September 1, 2024, this experimental framework will let certain businesses engage in digital currency transactions under the Bank of Russia's supervision.

Conclusion

The entire crypto community is observing intently as Russia advances with its intentions to include cryptocurrencies in its banking system. The success of these projects might inspire other nations to implement comparable policies, validating the use and mainstream adoption of digital assets on a global scale.