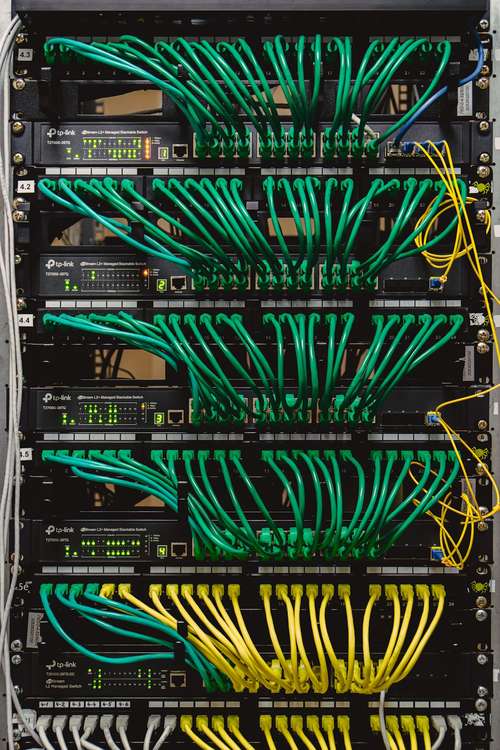

Hut 8, a cryptocurrency mining company, plans to invest $17.3 million in building a new mining facility in Texas.

The state is becoming an increasingly popular location for Bitcoin mining due to its low energy prices and large amounts of available land.

Hut 8 plans to start operations in Q2, coinciding with the Bitcoin halving event, and aims to quickly integrate miners into the proposed site.

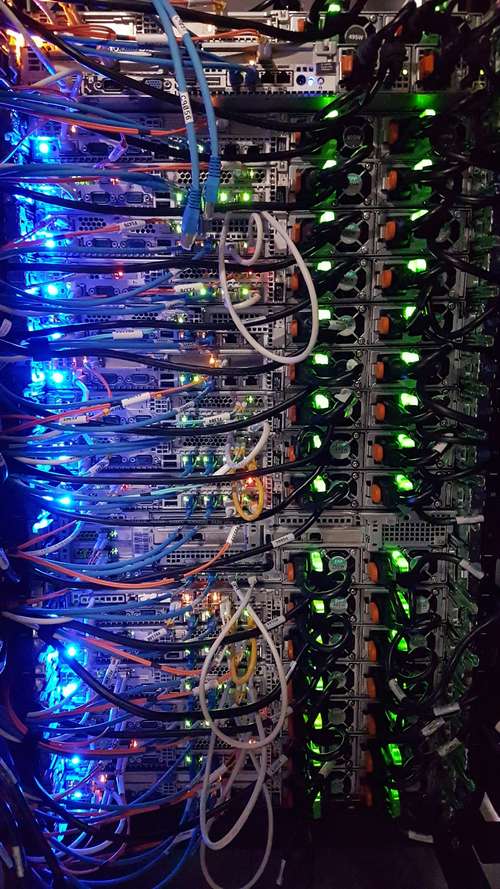

Asher Genoot, the CEO of Hut 8, provided insights into the company's shrewd financial strategies that significantly reduced the anticipated construction costs for the upcoming facility.

By leveraging efficient cost-saving measures, Hut 8 has managed to trim the projected expenses from an initial estimate of $29 million to a more streamlined $17.3 million. This translates into impressive savings amounting to approximately $11.3 million.

Genoot emphasized the in-house development team's pivotal role, highlighting how their expertise allows for swift and cost-effective project execution.

Hut 8's Culberson County site will cost under $275,000 per MW, more than 40% less than the benchmark set by recent regional acquisitions ($460,000 per MW).

Industry Analysis: Bitcoin Halving and Mining Profitability

The move by Hut 8 to establish a new mining facility comes against the backdrop of a broader industry analysis discussing the potential ramifications of the imminent Bitcoin halving on the profitability of mining companies.

The Bitcoin halving event, a mechanism ingrained in the Bitcoin protocol to reduce transaction rewards, serves as a mitigating factor against asset inflation.

While conventional wisdom might suggest that the halving could adversely impact mining profitability, recent insights challenge this notion.

BeInCrypto's recent report revealed that the halving is anticipated to double the average cost of mining one Bitcoin, projecting a range between $30,000 to $60,000.

This raises a critical question for major Bitcoin mining entities: will this be a make-or-break moment?

Navigating Challenges: A Crucial Period for Bitcoin Mining Companies

A mere two years ago, Core Scientific, another significant player in the Bitcoin mining arena, faced financial turmoil attributed to the escalating costs of running mining operations.

Profits were on the rise but at a slower rate, prompting concerns within the industry. In October 2022, Core Scientific, in a filing with the SEC, revealed that the board had decided to withhold payments for over two months.

The Bitcoin halving may affect mining profitability, but analysts are optimistic about institutional adoption and the potential approval of a Bitcoin ETF, driving a price surge and leading to enhanced profitability for mining companies.

Meanwhile, recent reports from BeInCrypto, dated February 27, projected that Bitcoin's market cap could skyrocket to $1.5 trillion post-ETF approval.

This projection is a tangible indicator of the increasing adoption of Bitcoin, a trend that bodes well for the profitability prospects of companies engaged in the intricate process of crypto mining in the heart of Texas.

Institutional adoption of Bitcoin is being closely watched by analysts as mining companies prepare for the upcoming halving.

The correlation between institutional adoption and Bitcoin prices will determine the profitability of these mining giants.