The crypto industry celebrates the Bitcoin halving every four years since its creation. This event has grown to have a significant impact on the development of the apex cryptocurrency. It's so crucial that other crypto projects also keep a close eye on it and hope for its success.

Bitcoin halving happens every four years when the mining rewards for Bitcoin are slashed in half. Bitcoin's halving has consistently led to a significant bull run following its inception. In 2012, 2016, and 2020, the price of BTC increased by 8,450%, 290%, and 560%, respectively, in the year after each halving event. This price surge has been closely observed and documented.

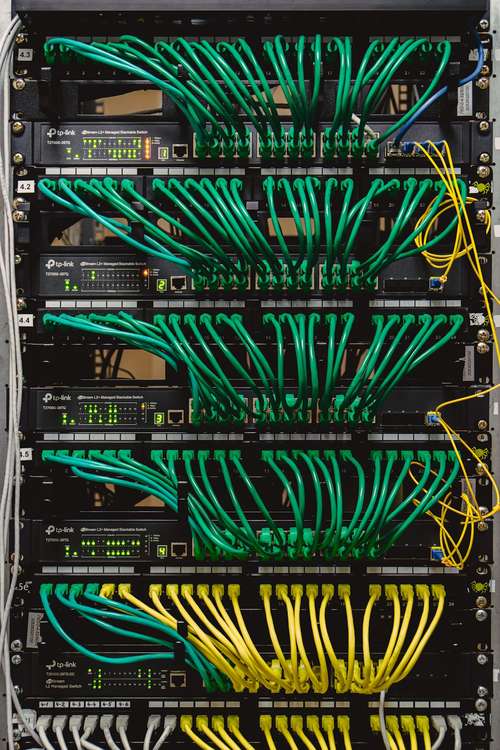

In the upcoming halving event, the mining rewards will decrease from the current 6.25 BTC to 3.125 BTC. In response to this reduction, miners have historically incorporated more advanced technology into their mining operations. Furthermore, since the value of Bitcoin has historically risen after each halving, miners can still sell their Bitcoin at higher prices despite the decrease in rewards.

But there's bad news for miners in the next Bitcoin halving countdown. The next Bitcoin halving is supposed to happen in 2024, but the outlook of things is making it look cloudy, especially for miners. No doubt, miners are an integral part of the crypto industry, but many Bitcoin miners might be pushed out of business due to many factors.

Miners To Get Less Profit

While speaking to Bloomberg, Jaran Mellerud, crypto mining analyst at Hashrate Index, said miners will struggle with the next halving. He mentioned that miners are currently struggling to keep up with the mining speed and capacity.

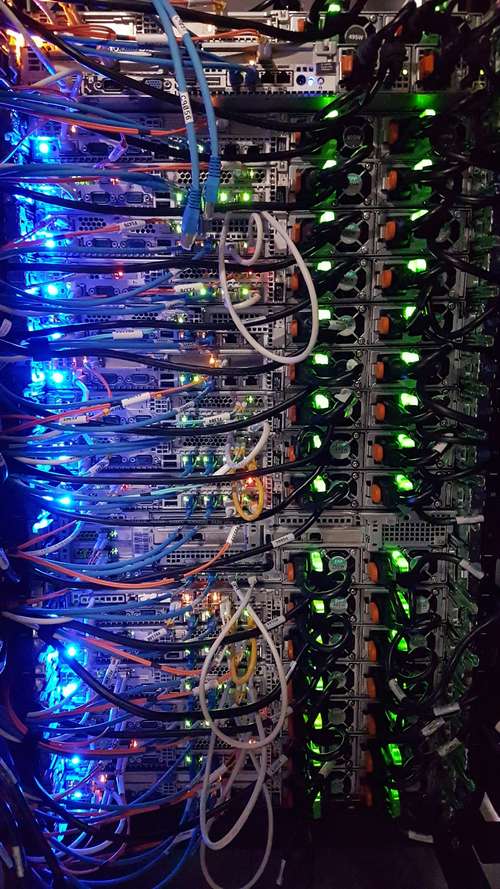

When it comes to mining Bitcoins, the technology and power used are crucial factors. In the past, the number of Bitcoins mined helped cover the costs of mining. However, with the halving, the amount of Bitcoin mined will significantly decrease, making it more difficult for many miners to sustain their expenses.

The cost of powering the machines used for the mining is simply high, Mellerud said. The crypto mining analyst acknowledged that the electricity price of powering the mining machines would drop from $0.12/kilowatt-hour to $0.06/kWh. Nevertheless, 40% of miners will operate at a higher cost than the average electricity price. In a nutshell, miners are set to face a hard period, which would see many of them leaving the business.

Net Profits To Turn Negative

The bad news doesn't stop coming as Wolfie Zhao, head of research at TheMinerMag, the research unit of mining consultancy BlocksBridge, said the Bitcoin miners' profitability will soon turn zero. Once the halving happens, several factors which helped miners to remain in profit would be removed.

"If you count in everything, the total cost for certain miners is well above Bitcoin’s current price.

Net profits will turn negative for many miners with less efficient operations," Wolfie Zhao said. Individuals aren't the only ones that would be affected; even large mining brands will also find it hard to keep up with the upcoming changes.