The Hong Kong General Chamber of Commerce (HKGCC) has taken an innovative step towards improving Hong Kong's economic infrastructure and addressing the region's manpower shortages.

They have proposed integrating Chinese Yuan-linked stablecoins, which could potentially bring about positive changes in the financial landscape.

The HKGCC underscores the myriad benefits of issuing stablecoins pegged to the Chinese yuan or supported by a diverse range of fiat currencies.

Such a move has the potential to fortify Hong Kong's financial resilience and facilitate seamless transactions within and beyond its borders.

Exploring the Virtual Asset Connect Scheme

In tandem with stablecoin proposals, the HKGCC advocates for exploring a "Virtual Asset Connect Scheme," which envisions deeper integration of virtual assets into Hong Kong's financial framework.

With an initial suggested daily limit of approximately HK$20 billion ($2.5 billion), this scheme promises to enhance financial integration and efficiency.

These proposals coincide strategically with the upcoming budget address by the Financial Secretary.

The HKGCC emphasizes the importance of attracting and retaining talent and businesses to fortify Hong Kong's operational environment amidst acute manpower shortages.

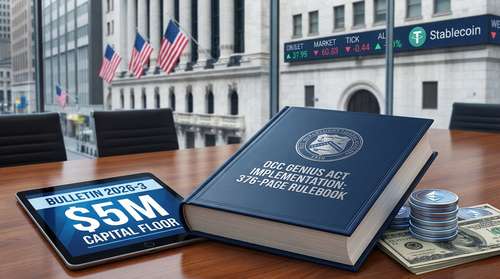

Regulatory Framework and Industry Response

The proposals put forward by HKGCC are in line with the current discussions taking place within Hong Kong's regulatory bodies, such as the Hong Kong Monetary Authority (HKMA) and the Financial Services and Treasury Bureau.

The regulators plan to create a sandbox environment specifically for stablecoin issuance, demonstrating a careful and cautious approach toward regulating this rapidly growing sector.

Christopher Hui, Secretary for Financial Services and the Treasury has unveiled plans by the HKMA to explore stablecoin issuance in collaboration with industry stakeholders.

Eddie Yue, Chief Executive of the HKMA, highlights the pivotal role of stablecoins in bridging traditional finance with the virtual asset market, emphasizing stability as a cornerstone for widespread adoption.

The integration of Hong Kong's stablecoin regulation represents a pivotal step towards embracing financial innovation for sustained growth in Hong Kong.

By leveraging the potential benefits of stablecoin technology and fostering regulatory collaboration, the region can position itself as a frontrunner in the evolving digital finance landscape.

Potential Challenges and Mitigation Strategies

While introducing Hong Kong's stablecoin regulation presents significant opportunities, it also poses challenges.

Chief among these is the need to ensure regulatory compliance and mitigate potential risks such as volatility and cybersecurity threats.

Collaborative efforts between industry stakeholders and regulatory bodies will be essential to address these challenges effectively.

The integration of stablecoin regulation in Hong Kong has immense potential to transform the region's financial landscape.

By embracing innovation, fostering regulatory collaboration, and addressing potential challenges, Hong Kong can fully utilize the potential of stablecoin technology to drive economic growth, enhance financial stability, and maintain its position as a global financial hub.

In conclusion, adopting stablecoin regulation in Hong Kong holds great promise for the region's financial future.