Core Scientific (CORZ), a cryptocurrency miner, reduced 10% of its workforce and severely decreased the assets it owned as the cryptocurrency drubbing continued to drag on the sector.

The layoffs were confirmed as the company reported its second-quarter quarterly earnings on Thursday, which included a $840 million charge to decrease the accounting value of its assets, bringing the Core's net negative for the time frame to $862 million.

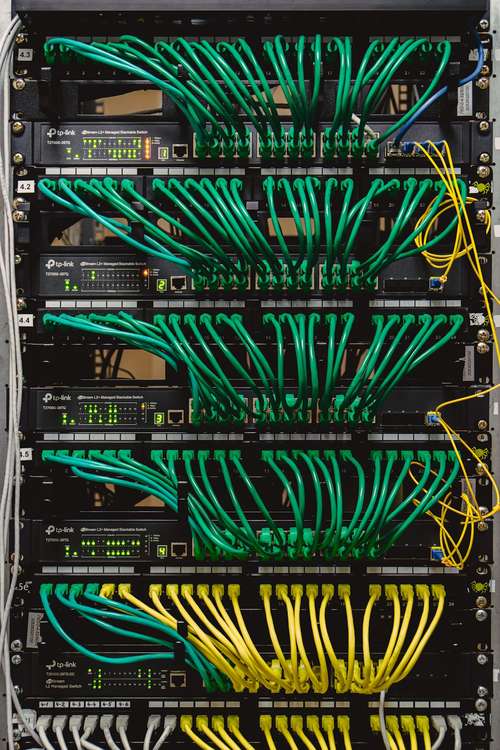

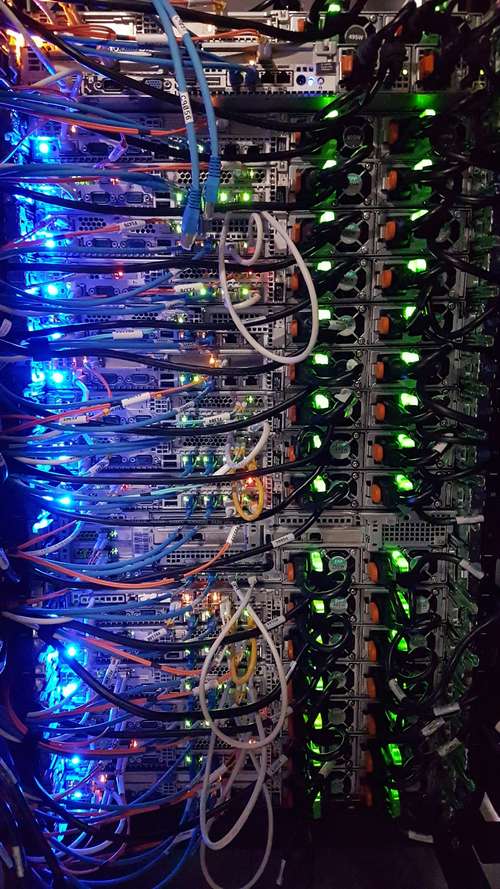

During the earnings conference call, the miner’s Chief Financial Officer Denise Sterling clarified that the staff cuts were "surgical" and did not impact operational personnel in Core Scientific's data centers.

The company, like other bitcoin miners during the crypto winter, has been compelled to beef up its liquidity. Core managed to sell more bitcoin than it extracted in July, in part to recoup expenses.

On the other hand, it sustained its prediction for the company's hashrate, an indicator of computing power on the Bitcoin network and an essential metric for mining companies.

Core Scientific trimmed its 2022 hashrate forecast to 30-32 exahash per second and cumulative power of about 1 gigatonne on May 12, citing market upheaval. On Thursday, the company has maintained its projection.

According to FactSet data, the miner confirmed $164 million in revenue, barely edging the average analyst approximate value of $161.8 million. The earnings report stated, “with revenue more than doubled over last year, due to "increases in digital asset mining revenue and hosting revenue, partially offset by a decrease in equipment sales."

During the earnings call, its Chief Executive Officer Mike Levitt asserted that the second half of the year will compensate for two-thirds of the company's growth this year.

But even so, the miner's personnel and facility expenses have gone up by 25% over the past year, and their power costs have managed to reach $0.05-$0.055 per kilowatt hour.

In response to several questions from involved analysts about the company trying to raise its power-cost preconceptions for the year, Levitt indicated its company's Georgia facility, where Core is most vulnerable to rising natural gas prices.

According to Levitt, the miner is trying to enhance its affiliation with its energy provider. The miner is also looking at expanding its operations so that economies of scale mitigate unit costs.

The company wells bitcoin on its own while also sponsoring the bitcoin mining machines of other industries. Hosting sales rose 110% from year to year, while self-mining revenue grew 920%.

After available rack space became limited, hosting was now in high demand. However, according to Levitt, "a lot of folks who don't have a home for their mining equipment also don't have capital," and it is only willing to work with clients who can render installments and are "very, very credit worthy."