Bitcoin's price has experienced a notable decline in recent weeks, raising concerns among cryptocurrency enthusiasts.

This article unpacks the key factors contributing to this dip, analyzing the roles of miners, long-term holders, and broader market sentiment.

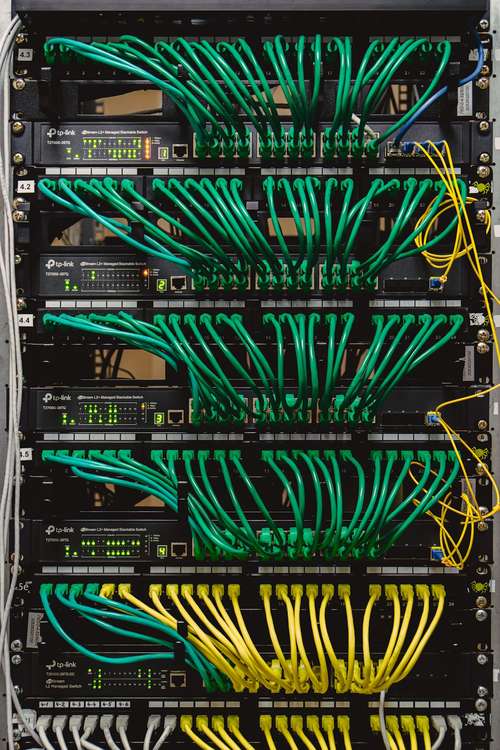

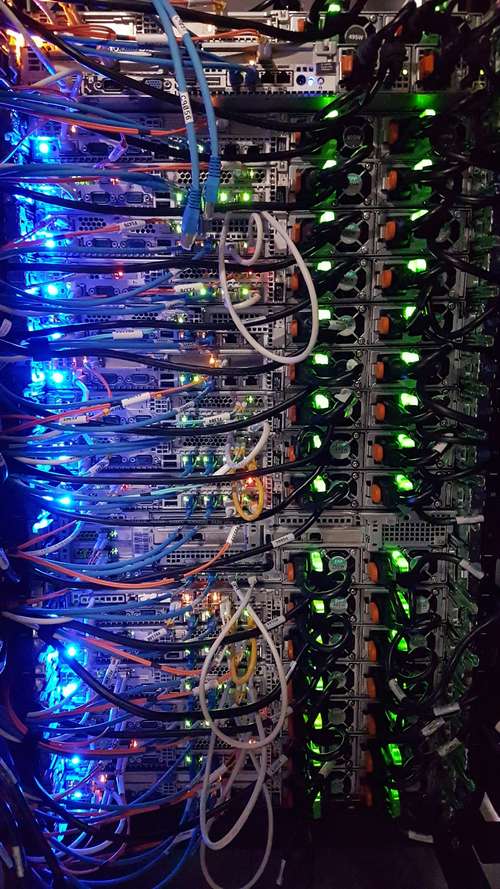

In April 2024, Bitcoin underwent its third halving event, a pre-programmed mechanism that cuts the block reward for miners in half every four years.

This event significantly reduces the amount of Bitcoin miners receive for verifying transactions on the network.

While the halving aims to control inflation and maintain Bitcoin's scarcity, it also presents a financial challenge for miners.

With their income halved, miners faced the dilemma of maintaining operations with significantly lower revenue.

Their operational costs, such as electricity and hardware upkeep, remained relatively constant.

To bridge this gap, some miners were forced to sell a portion of their accumulated Bitcoin holdings.

This influx of Bitcoin hitting the market increased selling pressure, contributing to the price decline.

Number of Bitcoin owned by miners | Sanbase

Long-Term Holders Take Profits: A Bull Market Opportunity

Another factor influencing Bitcoin's price was the behavior of long-term holders, also known as HODlers (Hold On for Dear Life).

When Bitcoin's price surged above its previous peak of $69,000 in early June, these investors saw a lucrative opportunity to cash in on their holdings.

This profit-taking behavior added to the selling pressure on the market, further pushing the price downwards.

While the intensity of selling from long-term holders has subsided since the initial price drop, their actions continue to impact the market.

Analysts at Bitfinex Alpha express concerns that if long-term holders continue to sell at current levels, it could exert significant downward pressure on Bitcoin's price in the short term.

This persistent selling could potentially extend the current price decline and even impact the overall bull market sentiment.

Market Dynamics: Decoupling and Uncertainty

The recent price movement highlights the complex dynamics at play in the Bitcoin market.

Traditionally, Bitcoin's price has shown some correlation with the performance of U.S. stocks.

However, in June, Bitcoin's price decoupled from U.S. stocks, suggesting that unique forces are driving the cryptocurrency market.

Bitcoin fell to a month lowest | CoinGecko

This decoupling underscores the still-evolving nature of cryptocurrency as an asset class and the factors that influence its value.

Signs of Stabilization, But Questions Remain

Despite the recent decline, there are some indications of potential stabilization.

The price on June 24th, though lower than its highs, was still above the lows seen earlier in May.

Additionally, the decline itself started before the halving event, suggesting that markets often anticipate such occurrences and price movements may be factored in beforehand.

Miner Reserves Dwindling: A Supply and Demand Equation

Data from CryptoQuant reveals a decreasing trend in Bitcoin reserves held by miners. These reserves represent the unspent Bitcoin miners have accumulated.

The current levels are the lowest since 2021, indicating that miners have been actively selling their holdings. This decrease in supply can put downward pressure on the price if demand doesn't keep pace.

Investor Sentiment: Fear or Opportunity?

While the price drop has shaken some investors, the value of miners' remaining holdings (in USD terms) remains high due to Bitcoin's recent price appreciation.

However, on-chain metrics from Santiment suggest that retail investors are currently cautious or uninterested in Bitcoin at its current price point.

This fear could be temporary, and historical trends suggest that periods of low investor interest can precede market rebounds.

The recent Bitcoin price dip is a result of a confluence of factors.

Miner selling due to the halving event, profit-taking by long-term holders, and broader market jitters have all contributed to the decline.

While there are tentative signs of stabilization, the situation remains fluid.

Continued selling by long-term holders could pose challenges, and the overall market dynamics for Bitcoin are complex and constantly evolving.