In August 2024, the Bitcoin mining industry reached a significant low point, with profitability plummeting to its lowest levels ever recorded, according to a recent report from JP Morgan. This downturn marks a critical moment for the crypto mining sector, driven by a combination of rising network hash rates and declining Bitcoin prices.

What Caused the Decline?

One of the primary factors contributing to the decline in profitability is the continuous increase in the Bitcoin network's hash rate. In the first two weeks of August, the network's hash rate rose by approximately 1%, averaging around 621 exahashes per second (EH/s). This increase, although modest, added pressure on miners as it reduced the overall profitability of mining operations.

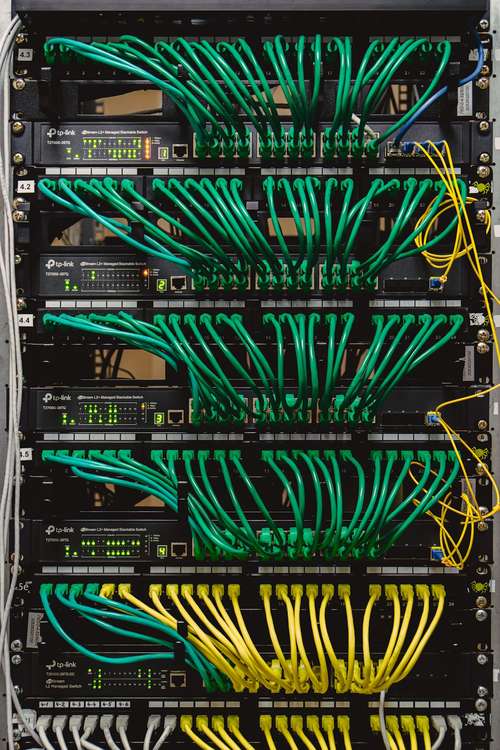

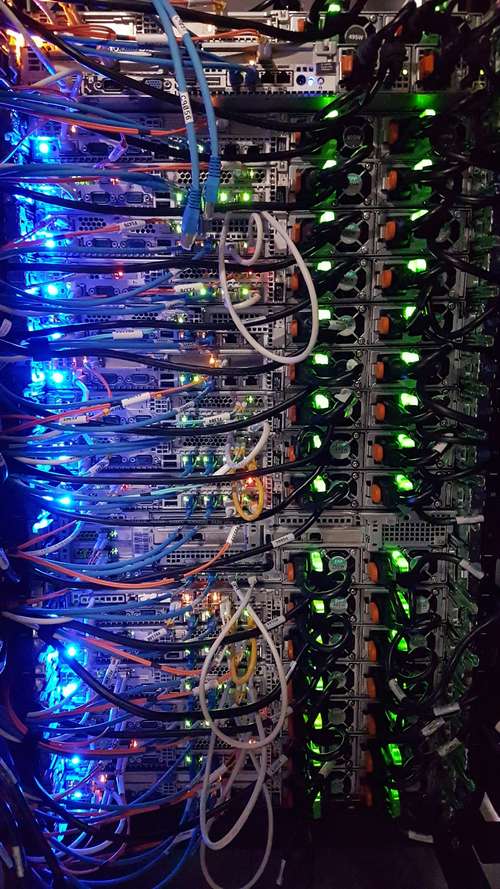

The rise in hashrate is largely attributed to advancements in mining technology and the entry of more players into the market, which intensifies competition. As more miners join the network, the difficulty adjusts upward, making it harder to mine Bitcoin. This has led to higher operational costs as miners must expend more energy and resources to solve the same number of cryptographic puzzles required to earn Bitcoin.

Impact on Bitcoin Market Capitalization and Mining Stocks

The decline in Bitcoin mining profitability has had a direct impact on the market capitalization of mining companies. JP Morgan's analysis revealed that the total market capitalization of the fourteen publicly listed mining companies tracked by the bank fell by 18% since the end of July. These companies are now trading at about twice their proportional share of the four-year block reward, indicating that the market is pricing in further challenges ahead.

Interestingly, despite the drop in profitability, the U.S. share of the Bitcoin network's hash rate reached a record 26% in August. This growth in market share highlights the dominance of U.S.-based miners, who have continued to expand their operations despite the unfavorable economic conditions. However, this growth may be unsustainable in the long run if profitability does not improve.

Miners Adapt to the Changing Landscape

Despite the grim outlook, some miners are adapting by holding onto their Bitcoin rather than selling at current market prices. This strategy suggests that miners are betting on a future price recovery and are willing to endure short-term losses in exchange for potential long-term gains. According to on-chain data, the rate at which miners are transferring Bitcoin to exchanges has decreased, signaling a shift in strategy.

While the immediate future may seem bleak, many miners believe that Bitcoin's price will eventually rebound, making their operations profitable once again. The continued investment in mining infrastructure by these companies further supports this belief as they prepare for a potential upswing in the market.

The Future Outlook

The future of Bitcoin mining remains uncertain, but several factors could influence its trajectory. The potential approval of a Bitcoin spot exchange-traded fund (ETF) could provide a much-needed boost to the market.

Additionally, innovations in mining technology and energy efficiency could help miners reduce costs and improve margins. However, until these developments materialize, miners will need to navigate the challenging landscape by optimizing their operations and possibly diversifying their revenue streams.

Bitcoin mining's profitability hitting an all-time low in August 2024 signals a critical juncture for the industry. Whether through technological innovation, market shifts, or changes in regulatory environments, the future of Bitcoin mining will be shaped by the industry's response to these unprecedented challenges.