As we near the inevitable mining event for Bitcoin, miners have gone out of their way to make the most of it.

Bitcoin miners spent over $747 million this month on equipment and facilities, gearing up for next year's anticipated Bitcoin halving event, bringing their investment sum to over $1.2 billion.

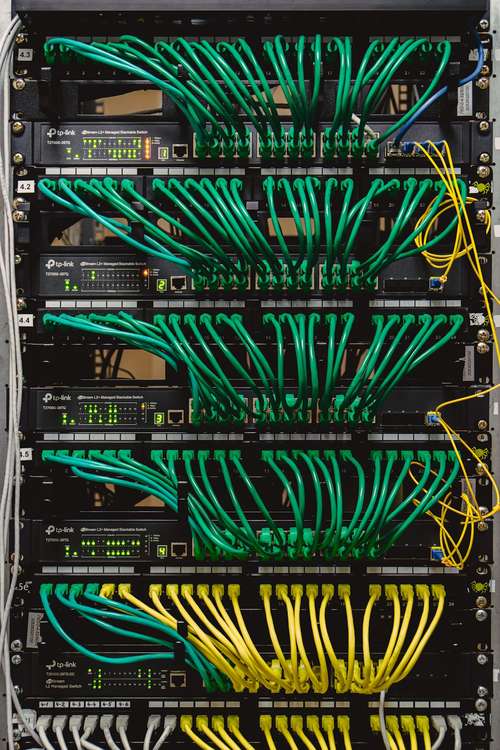

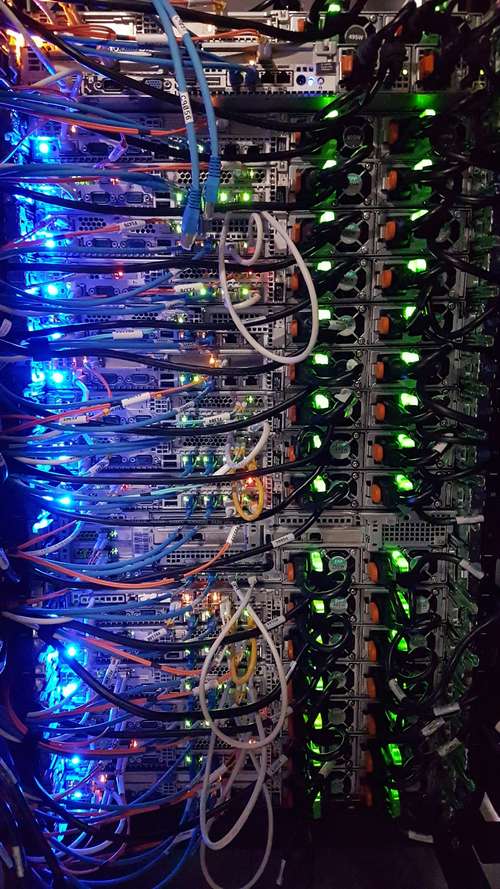

Pushing the Boundaries: Big Investments in Mining Rigs for Bitcoin

As the forthcoming Bitcoin halving looms, major players within the crypto mining sphere, such as Iris Energy, Stronghold Digital, and Argo Blockchain, are dedicating vast sums to procuring cutting-edge machinery and bolstering their operational infrastructure.

This influx of new equipment into the Bitcoin network aims to amplify its computational potency, concurrently escalating the complexity of mining endeavors and potentially eclipsing the competitive capabilities of smaller-scale entities.

In the wake of the previous bear market that constricted profitability, these investments reflect a proactive stance, wherein big mining entities are taking steps to reinforce their market dominance.

Companies like Marathon Digital, holding an estimated reserve of $700 million, are strategically earmarking funds for prospective acquisitions, foreseeing opportunities to absorb smaller competitors grappling with financial constraints amidst the crypto industry.

Halving Dynamics: Impact on Bitcoin’s Economic Sphere

The quadrennial event of Bitcoin halving holds enormous implications, diminishing the pace at which new Bitcoins are introduced into the market.

Past occurrences of halving have historically exhibited a bullish trajectory for the asset, accentuating its scarcity and instigating potential upward price surges.

Price Speculation Amidst Regulatory Anticipation

The recent surge in Bitcoin's valuation, soaring above $44,000, has been buoyed by the optimistic aura surrounding the prospective approval of multiple Bitcoin exchange-traded funds (ETFs).

Discussions at an advanced stage between ETF applicants and the US Securities and Exchange Commission (SEC) have been perceived as promising indications, amplifying hopes for a forthcoming endorsement.

Nevertheless, the SEC's cautious stance concerning spot Bitcoin ETFs, attributed to concerns regarding market manipulation risks, remains a big hurdle.

Despite this optimistic outlook, Bitcoin faced a slight setback amidst an Asian market sell-off, experiencing a temporary decline to $40,521 before rebounding to $42,500 in London, exemplifying the volatility inherent in the cryptocurrency sphere.

Industry Voices: Projections and Forecasts for Bitcoin's Trajectory

Several influential figures within the crypto industry have voiced bullish sentiments, forecasting a robust future for Bitcoin in the years leading up to and following the halving.

Michael Saylor, a known Bitcoin advocate and MicroStrategy chairman, conveyed an optimistic outlook in a recent CNBC interview, projecting a tenfold increase in Bitcoin's value. Emphatically, he expressed a sentiment foreseeing a time when individuals would proudly reminisce about acquiring Bitcoin at five-figure prices.

Meanwhile, Adam Back, CEO of Blockstream, an important figure in mining infrastructure, projected a surge, predicting Bitcoin's valuation would soar to $100,000 before the impending halving event.

Cathie Wood, the CEO and chief investment officer of ARK Invest, envisioned the potential of Bitcoin-linked ETFs to outpace funds tracking Bitcoin-related equities in the long haul, highlighting Bitcoin as a secure haven due to its lack of counterparty risk.

ARK Invest's ambitious projection envisions Bitcoin reaching an astounding $1.25 million by 2030, placing considerable weight on its Bitcoin ETF application awaiting SEC approval by January 10, 2024.