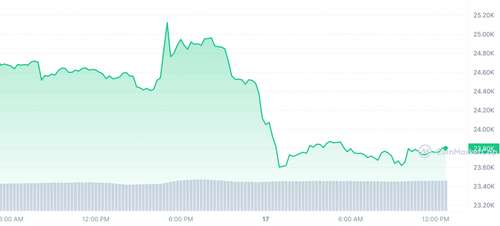

Data from CoinDesk shows that Bitcoin reached the $25k price threshold before coming down. This is the first time the apex cryptocurrency is reaching such a price tag since August last year. It was a huge feat for cryptocurrency, showing investors are determined to keep investing in crypto despite the huge regulatory crackdown on crypto firms.

As of Tuesday this week, Bitcoin was seen moving around the $22k level before beginning the massive surge to $25k. At the time of writing, the Bitcoin price is back down to almost $24k, which is still a huge price level considering the uncertainty in the crypto market. The United States Securities and Exchange Commission began a huge crackdown on crypto-staking firms and other companies, which led to massive trading apathy. The surge in Bitcoin price shows SEC excesses may not deter investors.

Following the surge in Bitcoin price, other altcoins followed its steps and increased in price too. Ethereum increased by almost 9% to reach the $1,700 level, although it is now down by $1,600 at the time of writing. Other major crypto assets, such as MATIC of the Polygon network and APT, increased by 12% and 9%, respectively. This has further increased speculation that a huge bull market might be waiting around the corner.

Crypto-related Stocks Are Also Bullish

After the Bitcoin price surge, it was also recorded that crypto-related stocks were also bullish within the period. Coinbase (COIN) increased by more than 3 percent during that time. One of the major Bitcoin holders and business software providers, MicroStrategy (MSTR), increased by about 2% during the same period.

However, these two weren't the only crypto-related stocks that increased during the Bitcoin price surge. The stocks of bitcoin miner company Marathon Digital Holdings (MARA) also increased to a whopping 4% during this time.

According to information from Nasdaq and S&P 500, the equity market was widely ticking down.

Crypto-related stocks increasing in value might not be a huge surprise for many investors as they have seen that happen whenever Bitcoin and other altcoins increase in price.

Terra and FTX Failures a Good Thing For BTC

According to many financial and crypto analysts, the failure of FTX and Terra was a blessing in disguise as it helped remove weak hands, which would have posed a major risk for BTC in the long term.

Mark Connors, head of research for Canadian crypto asset manager 3iQ, said that while speaking with CoinDesk, the failures of FTX and Terra helped Bitcoin decouple from weak crypto firms. According to him, "from a technical standpoint, weak hands were washed out of crypto in the aftermath "of the [Terra] and FTX failures so (there was) more upside risk for BTC."

Richard Mico, the U.S. The CEO of Banxa also spoke about the recent Bitcoin price surge, saying that it has helped many assets to rebound from oversold positions last year. "The December lows followed extreme volatility because of the FTX debacle, with the major crypto assets looking extremely oversold back then. It also appears there was significant tax-loss harvesting in December. Now, there are not that many forced sellers left in this market. They’ve already been washed out with various short squeezes," Richard Mico said.